Well, a good start to “learning how to invest” is Google and Investopedia. While this may seem basic, looking up terms you are unaware of and familiarizing yourself with terminology is the first step. Also, most trading platforms like ThinkOrSwim, or brokerages like Merrill Lynch will have their own specific resources for how to trade with their tools. Even your post is a good start: you asked a question, I’m sending you out to resources.

You’ve heard the old adage,

give a man a fish, feed him for a day;

teach a man to fish, feed him for a lifetime.

This is no different - “hot stock tips” are almost always scams and even if they make you a dollar, you didn’t learn anything. Based on the Nobel Prize winners in Economics, Eugene Fama and Danny Kahneman, they have published their respective theories of efficient markets (EMT) and lack of rational thinking by humans (behavioral economics, BE) and even then their award-winning papers, analysis, and peer reviewed studies show that the best new 5-factor algorithm only accounts for about 87% of price movement versus 70% of the original EMT. BE, predictably, covers the irrational side of price movements, and that is tied to the random walk hypothesis - the idea that random movements are interpreted as patterns, signals, and events by humans despite it being truly random.

So there are definitely still “money’s to be made” in those 30%-13% market inefficiencies by finance players, but it requires time, dedication, training, and yes, some luck (at least until we can 100% predict random events, which I believe science may never be able to do, but we will keep shrinking that 13% figure).

I love those economists, and you can’t go wrong reading any Nobel Prize winner…but some books are not as accessible to new learners so check reviews in advance to see who the target audience is. Audiobooks are great for learning because I tend to workout while listening to light/simple economic topics and relisten to them if I need to absorb more info or take notes. When asked to expound on specific strategies, Nobel Economists preach the basic winning strategy that has worked and will work for ever: live within your means, pay off debts ASAP from highest interest to lowest, and invest as much as you can as early as you can.

In modern society, from Dave Ramsey to Mr. Money Mustache to JL Collins, these are “money pop stars” that regurgitate the same things the Nobel Laureates are saying but in popular methods like on blogs, writing books, or speaking at seminars or through a podcast. They’re not bad people, but in my mind they are businessmen making money selling free knowledge. I will say they benefit the masses by providing easy to follow guides or steps for doing the basics, so there is definitely a net positive to have “money pop stars” like them preaching varying degrees of frugality, charity, consistency, and fear avoidance.

For the average Joe, there is no timing the market - even the “experts” routinely get it wrong. You can, however, dedicate X hours to studying a microcosm of the market - a unique snippet that you understand just as well as the experts. Maybe you only want to spend 6-9 hours a year managing your finances; it is not in your best interests to be picking individual stocks, ever. There is nothing wrong with that, you just need to follow conventional wisdom that says to invest mostly in a large stock fund or ETF (usually ETF due to lower fees) and a smaller chunk in bonds. It’s no secret, and the only thing people disagree on is what percentage should be in stocks and what percentage in bonds. 80-20 is a good rule of thumb (80% in stock ETF, 20% bonds), but 90-10 can be better for younger, more aggressive portfolios that have longer time to recover from a major depression. Or even 70-30 as you near retirement. 6-9 hours a year is more than enough to make big, passive investment choices like that.

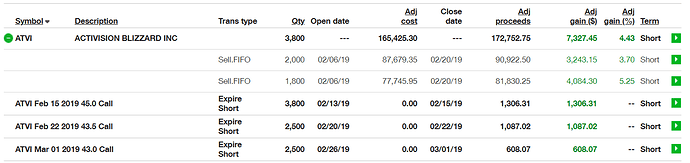

However, if you have 6-9 hours a month you might be able to become the expert of a single company. You pour over the financial statements and build your own analysis, you listen in on live earnings quarterly, you setup alerts on your phone for anything related to $ABC company, and you know exactly how any given announcement will impact the stock in advance so you can make plays instantly (or you already wrote algorithms to execute the trades as soon as they happen). That may seem daunting but there are 1000s of publicly traded companies - you can’t be the expert on them all, but you can be the expert on one. Again, that doesn’t guarantee you always make money, but it does give you a higher likelihood of consistently beating the rest of the market to any reaction.

Now let’s say you have 6-9 hours a week to dedicate solely to investing…instead of being an expert covering 1 company, you might be able to cover the entire sector, like gaming. Or an industry, like entertainment. It’s basically the same as covering 1 company, but you can have your algorithms covering multiples within the same field.

And finally, 6-9 hours a day. At this point, it is your job. You better know/be an expert on something, somewhere within the market, and have an edge or you’re just wasting your time and money. With 6-9 hours a day, you can cover macroeconomic trends that are effecting world economies as well as individual companies and sectors. You’ll still have a specialty (no living human can track, much less invest intelligently in, every stock) but it will be much broader than most, covering many companies.

Finally, to answer @Vindace, video game companies are - at their core - an entertainment company with fickle fanbases, some of which are also fickle investors. This means they overreact to almost all news, and it has been confirmed in study after study of entertainment industry stocks. “Sell the news” is a common mantra for entertainment experts, and what they mean is usually the hypetrain will send the stock too far in one direction or the other…

…so how does that translate into actual trades? A simple algorithmic trigger that says if the stock is moving up more than 5% in a day, news obviously broke. If you had a social media monitoring system in place you might even be able to catch it before it moves the +5%, but either way go ahead and market buy and immediately slap a -1% trailing stop on it (just ballpark numbers, every stock is different). with a dip, it’s basically the same thing - if you own shares, sell immediately or short as its crossing the -5% barrier and pick the stock back up once it’s started recovering +1%. But that’s just how to trade news days. For the vast majority of trading days, you need to be able to read financials and deep dive into the company to see what it’s worth, long-term, and where it will be in years, not days. So it’s a completely different set of algorithms governing whether you want to own something long-term and when to sell. You have to do you own research for every single company, and stay up-to-date.

That’s today’s contribution! Keep up the questions!