I still don’t know how short selling works… But this makes some sense.

Uh…for a normal, healthy company I’d agree with you but I’m not sure ATVI is that. It is definitely not a sure thing and many negatives are piling up in addition to the truth finally coming out about business practices ATVI has been engages in for years. Plus, just like EA they have not been actively developing new IP and with the destruction/mismanagement of their old IP we are seeing an exodus of gamers away from WoW, away from Diablo, away from Starcraft, etc.

For the record, I am hyper-bearish against ATVI and have significant short positions leveraged against their stock despite loving their games. Their copy+paste of EA’s style of executives and management has predictably caused shortsighted, quarterly goals that backfire longterm. $25/share is much much more likely than $80/share and other financial analysts agree with me based on the cost of their 2020-2021 derivatives markets.

TL;DR - Their cash cows are faltering and they are not developing much new stuff despite calling themselves “game developers” so they are overpriced and do not deserve even a $40/share valuation.

I’m going off the top of my head (pure memory) but I think the slide started 2 or 3 October. They have stumbled from one failure to the next for 3 months; -45.11% in that time. That doesn’t sound like a “buy the dip!” type of stock, but hey, if you want to throw away money at ATVI that is fine.

Buy and hope for a merger?

Also, I have this one question (and I know this requires us to speculate): Is this dip in stock price because Activision is not perceived by the market as a viable or profitable company (making this a really bad time to buy) or because Activision isn’t perceived as as profitable an investment compared to other companies in the game development field?

I only ask this because the amount of money that developers are expected to earn in order to be “successful” in the market, and the level of ROI for the quarter earning reports seem to have grown to crazy levels…

To answer your question, it is the latter. Investors know both sides of the company, Activision and Blizzard, are profitable right now. We know they have rabid fanbases. We know they can create amazing games. Overwatch was a huge surprise and excellent salvage of Project Titan. Hearthstone was another huge surprise cash cow. Heroes of the Storm, less so.

Bottom line - investors aren’t stupid - we can see current profits, we see things are going well(ish), we have therefore snatched up and driven the stock price through the roof (to $60+) on the hype/expectation that they would continue to release hit games…momentum investors see the dogpiling into ATVI and drove it up even further to $80+ because they follow the hypetrain (that’s literally in the definition of a momentum investor).

But let’s say we bring everyone back down to earth and compare them to other game publishers. What should ATVI actually be valued at if the next Call of Duty is only moderately successful? What if the next WoW expansion is another BFA instead of a Lich King or Burning Crusade? Clearly the Diablo franchise isn’t being taken seriously as it’s going mobile and micro transaction heavy, or if it is we aren’t going to see a Diablo 4 anytime soon (based on lack of any announcements). Heroes of the Storm is on life support. Starcraft is on life support, but probably something sitting on a back burner (Starcraft 3 or Starcraft: Mobile Edition? We don’t know…).

Overwatch AND Hearthstone are suddenly having growing pains as they realize this whole esports/league thing is going to cost ATVI a lot of capital, especially for physical stadiums and the profit is not there (yet) - not enough viewers, fans, partnerships, sponsorships, or advertising revenue to cover the costs of building out an esports league so right now Activision-Blizzard is feeling queasy covering those costs for 2 full years with little to show investors. Those of us that deep dive into the financials and books know this is tearing apart the company, as they invest in illiquid assets like real estate and property around the globe or sign 10-year leases for events…that ties up a lot of the cash they have stockpiled over the years and it may pay out in the future but by asset allocation they could arguably be categorized as a realty company instead of entertainment: video games.

These land and building purchases are costing them a fortune and they are worried (rightly so) and having every department start to cut costs. They’re even happy Bungie is leaving because to them that’s one less headache to think about as they try to solve this esports dilemma. It is a tough nut to crack, and they are still on the fence deciding if they want to go all-in, becoming a rival to the NFL or FIFA, or if they want to keep developing video games and publishing. They are trying to do both right now and that’s why all investors, from the clueless to the most savvy, are worried about ATVI.

TL;DR - Even if you love them, they have a tough road ahead with many difficult decisions to make.

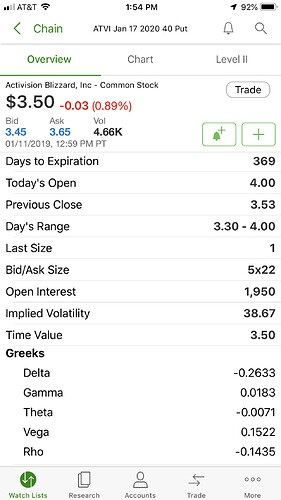

This picture shows that on Friday alone, 1000s of investors are PAYING $3.50/share for the option to sell ATVI at $40 any time before January 2020. That means many shorters like myself believe ATVI will drop well below $36.50 ($40.00-$3.50) in the next year.

Let’s say you believe ATVI will recover to at least $60 by January 2020. Seems reasonable right? You can’t afford 100 shares right now though at $46.55 each because you don’t have $4655 sitting around. Instead I will pay you $1590 if you promise to let me sell you my 100 shares for $60 each anytime before January 2020. What this means is, if it starts to get close to January and Blizzard is back to $65 or $70 you don’t have to do anything but laugh at me and play with the $1590 I gave you: because I would much rather sell my shares on the open market for anything over $60+ instead of the guaranteed contract price of $60 I have with you. And you get to do whatever you want with that $1590 (premium) I paid you for a year, convert it to one’s and scream dollah dollah bills, buy Chrono games, invest, whatever you want…

…But let’s say ATVI has as rough a year as I’d expect, maybe even pushing them lower to $25. I could go buy 100x$25 and force you to buy them from me for $6000 total. You still keep the $1590 though, so it’s somewhat of a consolation that you just paid (net) $4410 for $2500 worth of shares. You only lost $1910, that’s not that bad! Except I would willingly open 100x that number in short contracts with 100s of other bright eyed fanboys. And that’s what’s been happening. Often. Over and over again.

I’m not even mad you’re comparing me to Hannibal Lecter - very appropriately the way I treat newbie investors blindly throwing their cash behind their favorite products without any evaluation.

i’m not though, lol, it’s just a situational meme related to something u said, not who u r or what u might or might not represent (i know it’s probably not necessary to specify all this, but i do prefer to do so, lol); if anything, i would rather express the respect which i hold for yr insights on the subject

and as for they way u treat newbies, i’d say business is business, if they get into the game they must be ready to deal with the consequences, and there’s a good reason i stay far away from it; i’ve always known since a tender age that that just ain’t my thing

Except, EA does have some new franchises to liven their lineup. They’re awaiting both Sea of Solitude and Anthem, both of which are highly anticipated (despite some of the negative speculation that clouds Anthem).

Activision doesn’t have anything new on the horizon. Their business model is atrocious, and they are near-100% reliant on franchises they’ve struck gold on. CoD is teetering dangerously close to the deep end of innovation where they begin to alienate players thanks to CoD BOIIII, and now Destiny has been declared ultimately useless for their profits in an irreversible move seemingly meant to cut their losses.

Meanwhile, the Blizzard side has been rocked with controversy, and their entire market can be seen on the front page of BattleNet. Many of these games will make minimal profits, and the only real sellers they have are Hearthstone, an ancient MMO that once shared the same IP as Hearthstone and rarely shows up in the press for good reasons, and Overwatch.

ActiBlizzard is in some deep, deep piles of s___ right now. Like Shalandir, but not happy at all.

Here’s a better question: why “buy the dip” even if you are an ATVI fanboy when you could invest in a dozen other better publishers? Ubisoft? CD PROJEKT RED? Take Two (TTWO) Interactive which owns 2K Games and Rockstar Entertainment that just pushed out another record-shattering game, Red Dead Redemption 2 after setting all previous records with their GTA V? None of them have the controversy-ridden last 3 months that Blizzard has had.

Hell, you could even find a way to convince yourself Zynga is a better investment because at least you know there’s no surprises waiting for you (hint: they’re gonna release a bunch more mobile and social games). Or go hunt down Todd Howard and throw money at Bethesda (owned by ZeniMax) because they at least have solid IP even if they refuse to upgrade to a better game engine for a decade. Or many great Chinese developers that wear their micro transactions on their sleeve - YY Inc. (YY), Changyou.com Ltd (CYOU), NetEase (NTES), TenCent (TCEHY)… or stick with the old school, well-established Japanese conglomerates: Nintendo (NTDOY), Sony (SNE), Capcom (CCOEY), Gravity (GRVY), Sega (SGAMY), or Square Enix (SQNNY). These are the US ADRs, so if you prefer to hunt down the Shanghai or Tokyo exchange ticket symbols, go find them because all but one (1) of them will be in a better place than ATVI a year from now.

or just

in 10 years

Personally, I prefer CYOU, YY, and NTES

(because)

TCEHY is overhyped and overbought most months - and the Chinese government has a hard-on for dicking over giant gaming companies like TenCent, as shown by their reluctance to approve any of TenCent’s new games after the temporary thaw on the “new game approval freeze” that has been in place since spring 2018. But I still like TenCent as an investor so anytime they have a dip, that is one of those stocks you “buy the dip” and I’ve slowly been building up a position in them; never sold any of those shares.

The massive revenue increases during the lootbox years probably caused a few of the biggest publishers to become overvalued. I think the huge drop in value from ATVI is the market’s recognition and response to it. I wouldn’t invest in the video game industry for any short-term gains unless you’re willing to bank on the expansion into the Chinese market space. Still wouldn’t do it seeing how the Chinese market has slowed, too.